GfK’s insight director, Helen Collins takes a look at how over a year of restrictions due to the pandemic has impacted on the baby market.

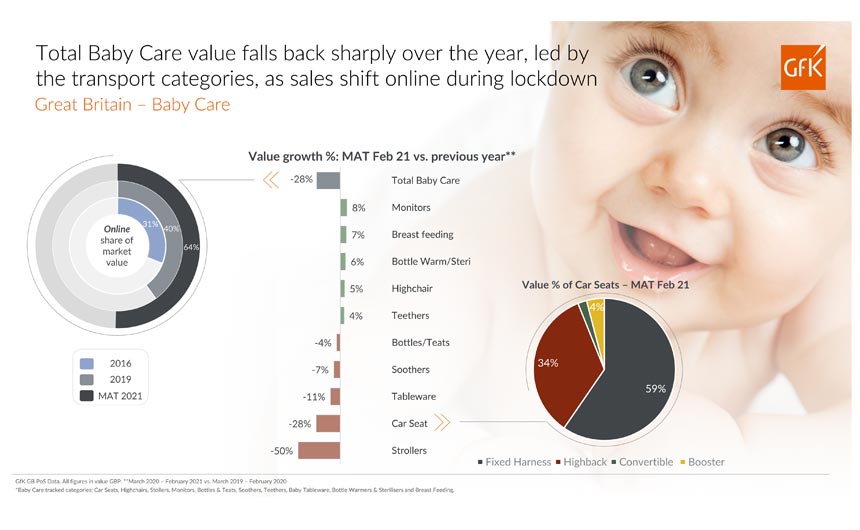

Covid restrictions have certainly had an impact on the baby market tracked at GfK. Value is down 28% in the last 12 months, compared to just -5% in the previous 12 months.

The largest declines come from the two most premium segments: Strollers (-50%) and Car Seats (-28%); both categories hit strongly from the ‘Stay at home’ rules, while other sectors such as teethers, feeding, high chairs and monitors all grew year on year.

Non-essential shop closures have meant an acceleration in the shift towards online sales. In 2016, 31% of Babycare value went through online transactions. This slowly increased to 40% in 2019, but Covid restrictions saw online sales rocket to just shy of two thirds value (64%) in the last 12 months. We expect the total market online share to be larger than this still as manufacturer’s direct sales are not included within the GfK figures.

We predict in-store sales to regain some of this share loss when non-essential shops re-open, but we don’t expect online sales to fall back to 40% as consumers have changed their shopping habits. Working from home is expected to continue to some level for a lot of the GB population, meaning that factors such as home delivery isn’t such a problem.

In the last 12 months, the car seat market excluding base has declined 29% in value and 31% in volume, while average price has remained fairly stable at £82. Similarly to the total babycare market, online sales have seen some growth, up 5% compared to in-store decline of -56%.

Take a Seat

Car seats is split into four main segments: Booster seat, Convertible seat (has a removable backrest so can be used as a booster), High back seat (no integrated harness, the adult seatbelt holds child) and Seat with fixed harness (typical baby seat with own harness).

The Seat with fixed harness market is the largest in value at 59% and most premium with an average price tag of £119 but shows the steepest value declines, down 34%. High back seats is the second largest segment at 34%, priced at £75 and declines just 21% year on year. The cheapest segment is booster seats with a £15 average price tag, accounting for 4% value but 19% volume. Boosters are only approved for children weighing more than 22kg or taller than 125cm, in the last 12 months only 11% are ISOFIX compatible.

Following ECE R-44 Regulations, car seats are classified into groups which are based on the child’s weight and can be used for both seat belt or ISOFIX seats. Within the fixed seat harness market, the largest group with 44% market value is Group 0+/1 suitable for a child at 0-18kg and has the largest average price tag at £189. Second is Group 0+, suitable for a child at 0-13kg, has 27% market share and comes with a price tag of £140. With this second option parents need to upgrade their child seat to a larger group within the first two years of the child’s life.

Following from these first seats, the most popular choices are high back seats which use the adult seat belt within Group 1/2/3 (9-36kg) with an average price of £87 and Group 2/3 (15-36kg) priced at £66, both are suitable for children up to the age of around 12 years and will be the final car seat.

2021 will be an interesting year as Covid restrictions are eased and consumers find their new ‘normal’, potentially with different levels of disposable income in comparison to pre-Covid levels which will drive new trends in shopping habits.

This feature originally appeared in the April 2021 edition of Progressive Preschool. To read the full publication, click on this link.