GfK’s senior client manager, Alex Hall, reveals how there are positive signs for the baby care market at the halfway stage of the year.

After a chaotic year across the retail sector there are positive signs at the halfway stage of 2021.

This is demonstrated by GfK’s consumer confidence measure, based on consumers’ views of their personal financial situation and of the wider UK economic situation. The current index score for June 2021 stands at -9, still negative but 6 points higher than April 2021 and a massive 21 points higher than June 2020. While there are clearly many steps still to be taken out of the pandemic, this upwards trajectory does give optimism for future levels of consumer spending.

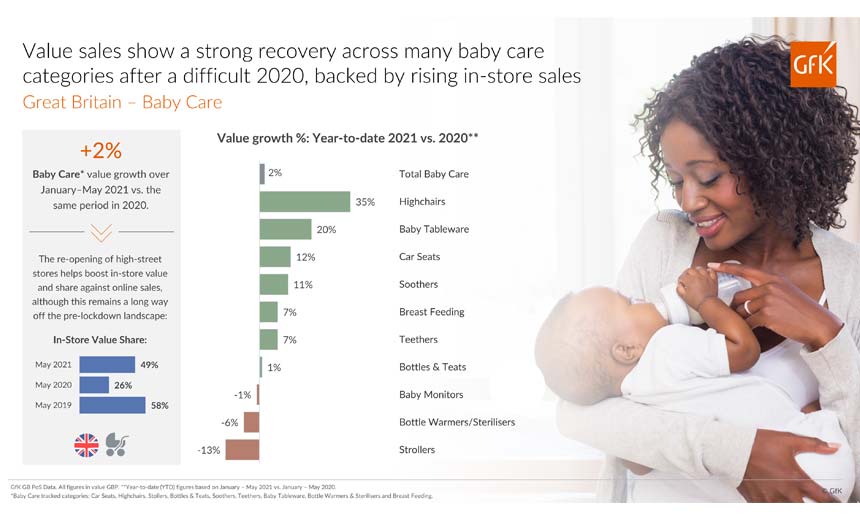

Where this spending is focused is more uncertain, but after a tough year for the baby care market things are looking up based on recent sales trends. Coming off the back of sharp declines over the first lockdown in 2020, April and May 2021 both saw year-on-year value growth in excess of 45%, driving the year-to-date (January-May) growth rate into positive territory (+2%).

This was backed especially by the re-opening of high street stores which, alongside supermarkets, drove triple digit growth for in-store sales into April and May compared to the same months in 2020. The proportion of value coming in-store in comparison to online stood at 49% in the latest reading, set to account for the majority again this summer. While this does mark a gradual reversal of the extreme change in consumer shopping trends, it also stands a long way apart from the pre-lockdown landscape – in 2019 60% of value came in-store and growth here would have to sustained far longer to recover sales lost over the previous 13 months.

At a category level, several areas have benefitted from the easing of restrictions and return of consumer spending.

Car seats – one of the hardest hit baby care markets in 2020 – shows year-to-date value growth of 12%. Highchairs and tableware products, which also recorded steep declines over the lockdown period, record even stronger increases of 35% and 20% respectively, the best performing categories in recent months. Value in the highchairs market has been boosted further by the average consumer spend on a model rising to just shy of £50 over January-May 2021, 20% higher than the same period last year. Like many areas, this is due to a combination of factors – reduced rates of price promotions, constraints on supply and an outperformance of various high-end brands, including new entrants to the market.

In contrast there are categories showing value declines, slowing the topline recovery. Baby monitors and bottle warmers & sterilisers fell back 1% and 6% respectively over the year-to-date despite seeing sales rise in-store. In both cases declines were heavily concentrated to April and May however, linked to the higher consumer attention towards and subsequent outperformance of these areas during the first lockdown last year. The reverse of car seats, highchairs and tableware, this is therefore more a sign of markets stabilising rather than a long-term indication of health and opportunities in these categories.

The other major category remaining in decline over 2021 to date is strollers, with triple digit growth in May unable to offset sharp early year declines, let alone the significant value losses over 2020. This is likely to be partly explained by ongoing shifts in consumer shopping habits – direct to consumer manufacturer and second-hand sales fall outside of GfK’s reported figures – but nevertheless raises concerns given the underperformance against other similarly tracked markets.

At the same time there are positive signs heading into the second half of 2021 when we look at a sub-category level. Buggies recorded a 7% uplift over the year-to-date, value sales rising over 100% in both April and May compared to the same months in 2020. Similarly to car seats, the high-end price ranges in strollers have also begun to recover value more consistently, with various brands operating at the premium end of the market bucking wider trends to achieve strong value and share gains.

Given the shock and extreme trends of the last year many categories are still in a recovery phase and topline growth must be put in context against the declines seen in 2020. Equally, like many other areas of life, there are several reasons to be encouraged looking ahead towards the later year.